Introduction What is an ERP system? And why should businesses use it? Today, small and medium-sized businesses (SMEs) also face some of the problems that large enterprises do. One of them being planning and managing their resources. SMEs face similar complexities but have limited resources to deal with them. Small businesses (like their bigger counterparts) have to: Do accounts to track their sales/purchases. Do their taxes. Pay their employees. Manage deliveries within promised timelines. Deliver quality goods and services. Communicate with customers, answer their queries. Large enterprises invest millions of dollars in highly sophisticated systems like SAP. SAP and similar systems are able to handle requirements from these large enterprises to bring their multi-country , multi-company , multi-currency , global businesses into a single platform. This has helped them achieve consolidation of data/records in the fundamental processes such as accounting, taxation,...

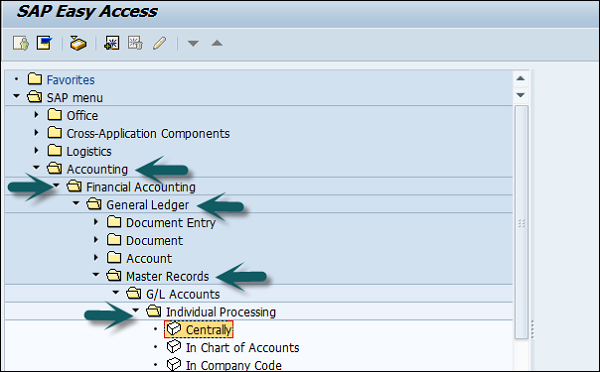

In SAP R/3, go to Accounting → Finance Accounting → General Ledger → Master Records → G/L accounts → Individual Processing → Centrally.

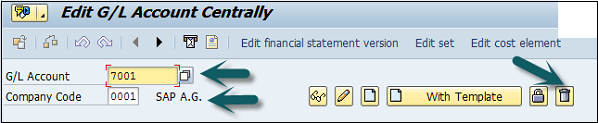

In the G/L Account, provide the account number of G/L account and the company code key. To delete a G/L account, click the Delete button as shown below.

The next step is to select deletion options for the G/L account −

- Deletion flag COA

- Deletion flag in company code.

- Select the correct check box and click the Save configuration.

SAP FI – Modify a G/L Account

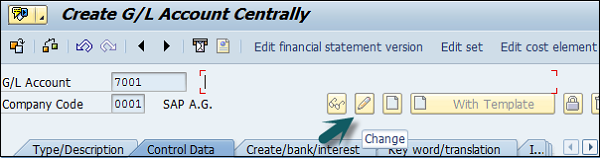

To modify a G/L account, click the Change option. Refer the following screenshot.

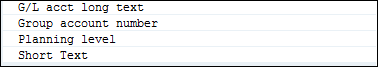

The next step is to select the changed field −

Click the Save button to effect the changes.

Comments

Post a Comment